Introduction: Why a $500 Emergency Fund Matters More Than You Think

Most people dream about financial peace — no more stressing over bills, no panic when the car breaks down. But saving feels impossible when debt piles up and paychecks vanish fast. Here’s the truth: you don’t need thousands in the bank to get started.

Research shows that even a $500 emergency fund can stop a single surprise expense — like a car repair or medical bill — from snowballing into high-interest credit card debt. This first $500 is your financial foundation, your safety net, and your proof that you can save.

Step 1: Open a Dedicated High-Yield Savings Account

Your emergency fund needs its own home so you won’t “accidentally” spend it.

- Choose a high-yield savings account (free and FDIC insured).

- Skip debit card access — out of sight, out of mind.

- Automate transfers every payday, even if it’s just $10–20.

Think of this account like your gym membership — it’s where you train your money discipline. Here’s a list of Best High Yield Savings Accounts from Nerdwallet, one of our favorite financial blogs.

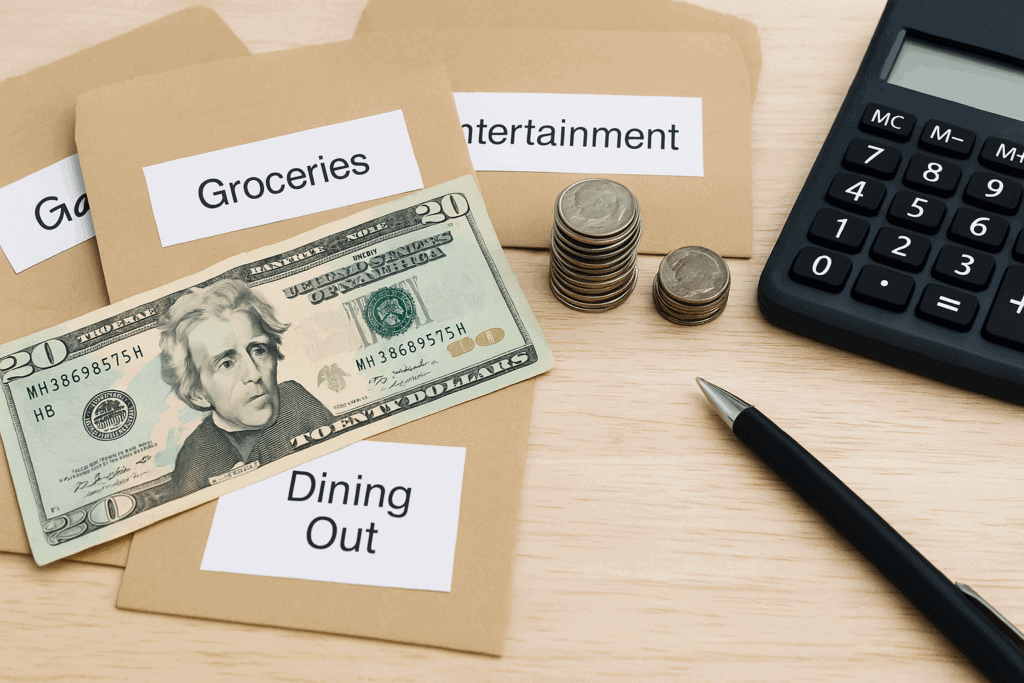

Step 2: Budget with Intention

Money doesn’t save itself. You need to direct it. A beginner-friendly budget shows where your cash is leaking:

- List your income and fixed expenses.

- Track your flexible spending (groceries, dining, entertainment).

- Trim just one habit (like the $5 daily latte).

Using a simple budgeting app makes this process painless — and freeing. RocketMoney is our favorite budgeting app. It not only lets you create custom budgets, but also tracks your spending into easy to view categories so you can make the most informed financial decisions.

Step 3: Try the Cash Envelope Method

The cash envelope system is old-school but powerful:

- Label envelopes for groceries, gas, fun, etc.

- Spend only what’s inside each envelope.

- Any leftover at the end of the week goes directly into your emergency fund.

This cash envelope kit on Amazon makes it easy to set up at home.

Step 4: Find Quick Cash Boosts

Want to hit $500 faster? Jumpstart with quick wins:

- Sell unused clothes, electronics, or furniture.

- Pick up a weekend side hustle.

- Cancel old subscriptions.

Even $20 here, $50 there — it adds up shockingly fast. The best sites for selling old stuff include eBay for rare items, Etsy for handmade or vintage goods, Poshmark for fashion, or Mercari for general items.

Step 5: Guard It With the Right Mindset

Your emergency fund is for true emergencies only — not vacations, not gadgets. Protect it with the same discipline you’d use to protect your body or mind.

Other Forge Posts to Maximize Your Path

🍳 Why Whole Foods Beat Processed Foods Every Time (Honest Food Forge) — cooking whole foods at home isn’t just healthier, it’s a budget lifesaver.

💪 The Best Beginner Full-Body Workout Plan (Fitness Forge) — building savings is like building strength: start with small reps and keep consistent.

🧘 How to Use Affirmations for Resilience (Your Daily Sign) — the same mindset that builds resilience in life helps you keep your savings safe.

Conclusion: The First $500 Builds Momentum

You don’t need to overhaul your entire financial life to make progress. The key is starting small – and $500 is the perfect starting line. With just this amount set aside, you create a buffer that shields you from everyday surprises: a flat tire, a doctor’s bill, or a broken appliance. It’s not about solving every money challenge overnight – it’s about proving to yourself that you can take control, one milestone at a time.

The first $500 does more than protect you from setbacks. It builds momentum. Once you’ve reached it, saving the next $500 feels easier. Every deposit reinforces your discipline, lowers your stress, and strengthens your confidence. Soon, you won’t just have a small safety net – you’ll have a growing cushion that gives you options, peace of mind, and the freedom to focus on bigger financial goals.

Remember, resilience isn’t built in a single leap – it’s forged step by step. Start small, stay consistent, and let the momentum carry you forward. Your first $500 is proof you can save – and the foundation for everything that comes next.

Forge Forward